Is Fiscal Conservatism Dead?

While Newfoundland and Labrador have not yet declared bankruptcy, they are on the verge.

Guess who engineered the downfall?

Oh, Danny boy, the pipes, the pipes are calling

From glen to glen, and down to oceanside.

The summer’s gone, and all the roses falling,

It’s you, it’s you who choose to quit, the rest must bide.

And, Danny Williams, the ninth Premier of the Newfoundland and Labrador, did just that. After setting the province up for failure, he walked away a hero. Was Danny as a fiscal conservative? Perhaps, but rather than setting up the Province for success as one might expect from a party and leader that preached fiscal conservatism, he and the party preferred, instead, to reap the benefits of power in the present. It’s the failing of many governments, not just the Conservatives, but it is an extra failing for the Conservatives as they profess themselves to be the party of fiscal prudence.

Related Posts

Left or Right: Is there a difference?

How to Game and Election

The SNC Lavalin Affair

The Kings of Conservative Media

The Changing Landscape of Politics in Canada

Part 1: Newfoundland & Labrador: A case study in how to fail

For those who think I have heaped to much blame on Alberta and British Columbia Conservatives for poor resource and fiscal management, let’s take a trip to the east coast for some relief. It seems the rise of Conservatism in NFLD under the leadership of Danny Williams in 2003, is eerily similar to the Alberta experience of the last two decades. This from a 2018 National Post article:

“When Danny Williams (that vibrant, outgoing, irascible, Irish politician) came to power as the ninth premier of NFLD in 2003, he promptly held a grim news conference where he warned that the provincial debt was out of control, and threatening to bankrupt the province. Fortunately for Williams, after one unpleasant budget and a nasty public sector strike, the price of oil rocketed from around $30 when he first took office, to $50 by the early months of 2005.

By the end of Williams’ first term in office, oil was flirting with $80 a barrel and it only climbed higher in his second term. Williams cut taxes and allowed spending to explode, fuelled by windfall oil royalties, right up until he quit politics in 2010, one week after he had announced a landmark deal for a multi-billion dollar hydroelectric project.

“During those good years, a few columnists, some policy wonks, and the province’s (Newfoundland that is) auditor general fretted that the government was living beyond its means, but the electorate didn’t care. After decades of crushing societal poverty, Newfoundland and Labrador was rich for a change, and Williams got credit for the economic miracle.”

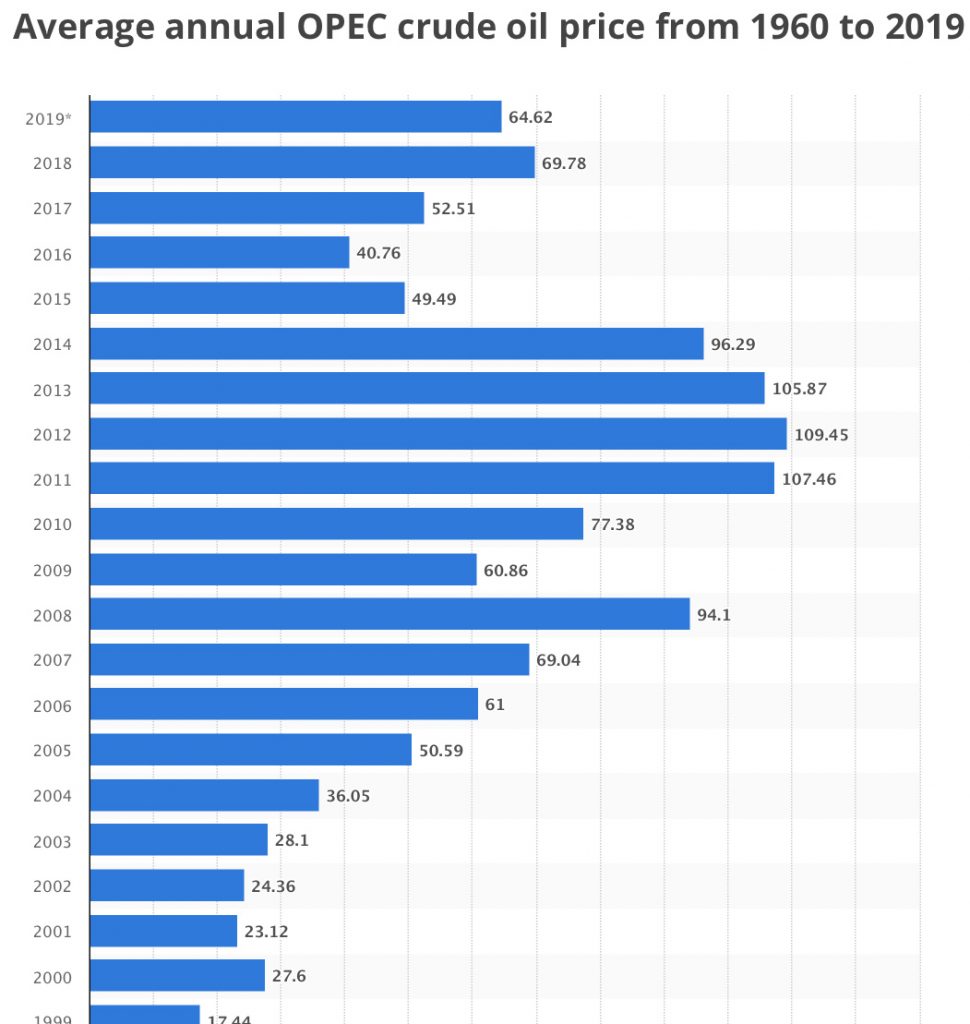

In the years following oil revenues continued to rise, often above the $100 mark. This provided a remarkable source of income for oil-producing provinces such as Newfoundland and Alberta as well as significant benefits to others such as British Columbia and Saskatchewan. Canada that also reaped many benefits as they were also being governed by fiscal conservatives (there is a correction for SK in footnote (5)). What did they do? They all cut taxes, particularly for big business and they spent every nickel as if the coffers would never dry up.

often above the $100 mark. This provided a remarkable source of income for oil-producing provinces such as Newfoundland and Alberta as well as significant benefits to others such as British Columbia and Saskatchewan. Canada that also reaped many benefits as they were also being governed by fiscal conservatives (there is a correction for SK in footnote (5)). What did they do? They all cut taxes, particularly for big business and they spent every nickel as if the coffers would never dry up.

Chart 1. (above) Average oil prices from 2000 – 2019. A more complete month by month record is provided in footnote (1) or you can link here to several long-term Crude Oil Price Charts

In NFLD, Danny’s, “reorganization of health and education; a negotiated Second Atlantic Accord to keep 100% of oil revenues in the province; and, negotiated deals to develop Hebron offshore oil field and expand Hibernia oil field; successfully opposed sale of New Brunswick Power to Hydro-Québec; further development of Lower Churchill Project and Muskrat Falls with transmission lines to Maritimes and the US…“, was a dream come true.

Perhaps sensing the danger in his mad dash to the top, Danny Williams resigned in 2010 claiming the Province to be in the best shape it had been since joining the Confederation. There is no question it was, but would it hold?

Three Conservative premiers followed in quick succession – Dunderdale, Marshal, and Davis. They each rode the Williams wave as if the world was their oyster. In 2012, Kathy Dunderdale, glowed about the “lasting benefits to  the people of Newfoundland and Labrador” when she announced Muskrat Falls was officially sanctioned.” Dunderdale held her own for three years, but it was clear the finances were beginning to unravel when she left.

the people of Newfoundland and Labrador” when she announced Muskrat Falls was officially sanctioned.” Dunderdale held her own for three years, but it was clear the finances were beginning to unravel when she left.

Over six months from June – December 2014, the bottom fell out of oil prices (Chart and Footnote 1). While it was bad for everyone, it was far worse for the governments of Newfoundland and Alberta, who suddenly found they were broke after never having set aside one dollar in a rainy day fund.

Still worse in Newfoundland, the Muskrat Falls hydro project had become a financial disaster of massive proportions. While the next two Conservative Premiers, Marshal, and Davis, hung on for a few months, they fell to the Liberals in 2015.

The new Premier, Dwight Ball, called Muskrat Falls “the greatest fiscal mistake in Newfoundland and Labrador’s history.” He called for an independent inquiry led by provincial Supreme Court Justice Richard LeBlanc, to examine how the Labrador project was approved and executed, and why it was exempt from oversight from the Public Utilities Board. The final report due is due by December 2019. As oil prices never recovered to anywhere near those record highs, Newfoundland, today, stands on the verge of bankruptcy.

Update: It has just come to my attention that the Muskrat Falls hydro project was originally provided loan guarantees of 5 billion under the Federal Conservatives. In 2017, the Federal Liberals added another 2.9 billion on a project that will now surpass 11.4 billion. While the Conservatives heaped scorn on the Federal Liberals for having bailed out the Trans Mountain pipeline project by purchasing the line for $5 billion, they have short memories of their own bailouts. Link: New loan guarantees for Muskrat Falls

February 23, 2020. The Muskrat Falls injury was to be completed by December 31, 2020. As of this date, I cannot find any reference to how the inquiry has progressed or that it was given an extension. Ref: Muskrat Falls Inquiry terms of reference (the most recent Google link)

This is the latest information I could find (from February 12, 2019) Muskrat Falls Inquiry Wrapping Up

Part 2: The Alberta Challenge: Canada’s richest province also goes broke in 2015

While Alberta was left somewhat better off than Newfoundland, that came about because they never started a Muskrat Falls type mega-project. They did, however, with little financial oversight, spend billions on pet projects and disastrous investments that ate away the oil income (2).

When oil prices began to tumble and sensing disaster on the horizon, the conservatives, who, by that point, had split into warring parties, turned the entire mess over to the NDP. It was an astute move on their part as by a strange twist of fate, it was the Wild Rose party that best understood the failings of the Conservatives, and, the Wild Rose was willing to expose those failures, something no conservative wanted see happen.

For the NDP it was the worst possible time to come to power. They were faced with a massive loss of income and the coffers were empty after years of overspending. Then came the floods and wildfires that further stretched the government resources to the breaking point. The NDP had no choice but to incur large deficits.

For the Conservatives it could not have worked out better – they got rid of the Wild Rose and Brian Jean in one fell swoop. They installed a Harper Minister, Jason Kenny, as their leader, and they blamed the entire financial mess on the NDP. Whatever they couldn’t stick on the NDP, they blamed of the Federal Liberals. As usual, Albertans swallowed the bait hook, line and sinker and put the fox back in charge of the chicken coop.

What never gained traction in the election was what the Conservatives had done to destroy the legacy of the oilpatch. No money left, no refining facilities and no pipelines to take their oil to market. They had fifteen years in this century, with sky-high oil prices, and they had friendly governments in Ottawa and B.C., yet they did nothing to prepare for the future.

The Conservatives tried a similar same strategy in Newfoundland (in their case, it was “blame the Liberals”) but the voters were not so naive and awarded the Liberals a second massive second-term majority.

Conclusions

In NFLD, when Danny Williams took over, the debt was $10B. When he left in 2010, he had only shaved $2B off the figure. During their Conservatives the last term in office, from 2011 – 2014, a time of record-setting high oil prices, they even added $1B to the debt. Since that time the debt has continued to rise and is now $14B. It’s doubtful they can weather this storm and it’s almost certain the rest of Canada will need to help bail them out.

In Alberta, only time and, perhaps, a rise in oil prices will save the province from the same fate as NFLD. The challenges they face are that bitumen now dominates their oil exports and it’s a product that’s increasingly hard to sell on the international markets. As Alberta has never successfully diversified its economy in a manner that reduces its dependence on oil, it is left in an extremely vulnerable position.

Footnote (4) provides background on the federal conservative contributions to the Canadian debt during the years in power.

All this begs the question, “is fiscal conservatism dead?” More to the point, perhaps it never lived?

Harold McNeill

Footnotes

(1) Crude Oil Prices 70-year history. Link to the full series of Crude Oil Price Charts

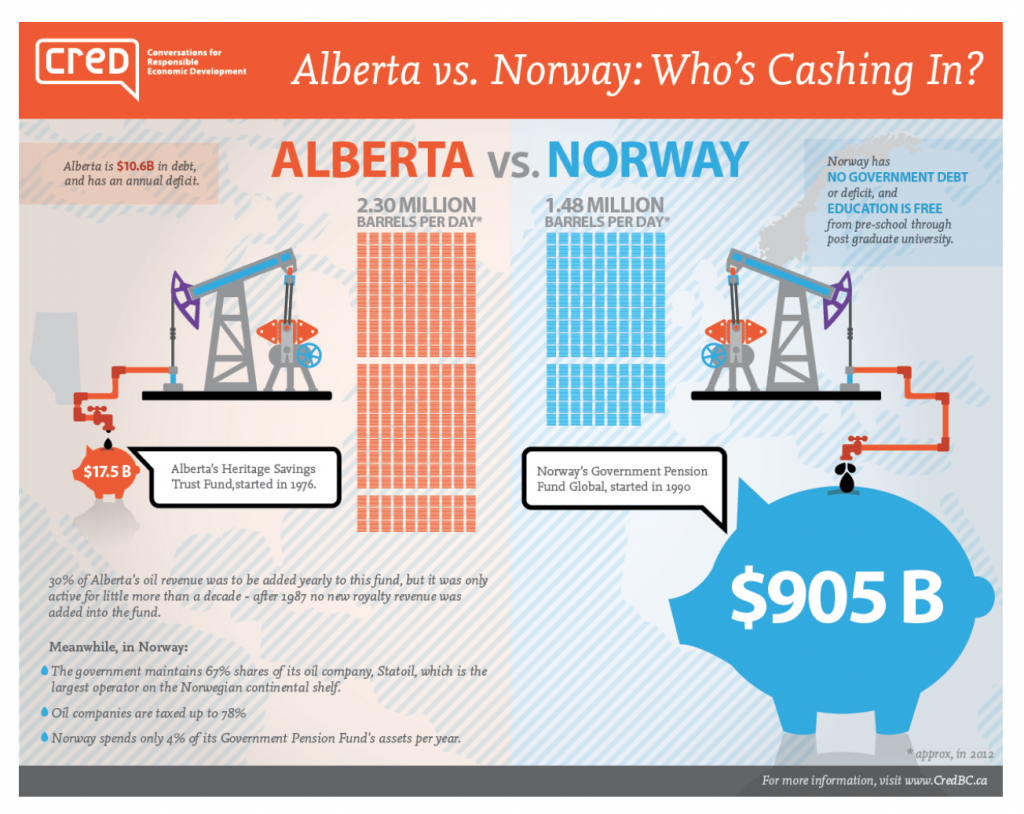

(2) Alberta Heritage Savings Trust Fund (HSTF)

The Alberta Heritage Savings Trust Fund (HSTF), established in 1976 by former Alberta Premier Peter Lougheed, had three objectives: “to save for the future, to strengthen or diversify the economy, and to improve the quality of life of Albertans.” The HSTF operates under the Alberta Heritage Savings Trust Fund Act and provides “prudent stewardship of the savings from Alberta’s non-renewable resources by providing the greatest financial returns on those savings for current and future generations of Albertans.”

The Heritage Savings Trust Fund used oil revenues to invest in the long term in such areas as health care, education, and research and as a way of ensuring that the exploitation of non-renewable resources would be of long-term benefit to Alberta. As of 2012, the fund was invested in stocks, bonds, real estate, and other ventures, with the aim of generating revenue for the province.

Between 1980 and 2014, although non-renewable resource revenues (NRR) in Alberta generated almost $190 billion[7], the value of the Heritage Fund in 2014 was only $17.3 billion.[8] After 1987, NRR was no longer added to the Heritage Fund.[4] By 2009, after losing $3 billion in the markets, the value of the Heritage Fund had dropped to $14 billion, which was its value in 1985.[5] The Alberta’s Heritage Savings Trust Fund (HSTF) was worth $17.5 billion as of March 31, 2014 according to the Alberta government’s 2013-2014 annual report.[1] According to the 2018-19 annual report, the “fair value” of the Fund was $18.2 billion on March 31, 2019

Initially, the fund received 30 percent of Alberta’s non-renewable resource royalties. Over time, successive Conservative governments propped up dubious ventures in domestic sectors ranging from forestry to aviation and food processing.

During the early 1980s, the fund made loans to other provincial governments in Canada. Later the fund’s money was used for capital infrastructure projects. In 1983, $25.5 million from the AHSTF was used to build the Kananaskis Country Golf Course to diversify Alberta’s economy while Premier Peter Lougheed was in office.

During the late 1980s and 1990s, the view emerged that government “should not be in the business of business and should not be so actively engaged in shaping the future. The Alberta Heritage Savings Trust Fund was shifted away from strategic business investments to become a savings tool investing for financial return. Investment in the fund was halted in 1987. Ralph Klein, who was Alberta Premier from 1992 through 2007, used the HSTF to fund special projects to encourage economic diversification. During the mid-1990s, public opinion turned against allowing governments to dip into the Heritage Fund to fund special projects, and instead, all income earned each year began to be withdrawn from the fund and added to general revenues.

If you have an interest in reading more background one how Alberta has, over the past three-quarters of a century squandered its oil wealth, read this article in Alberta Venture.

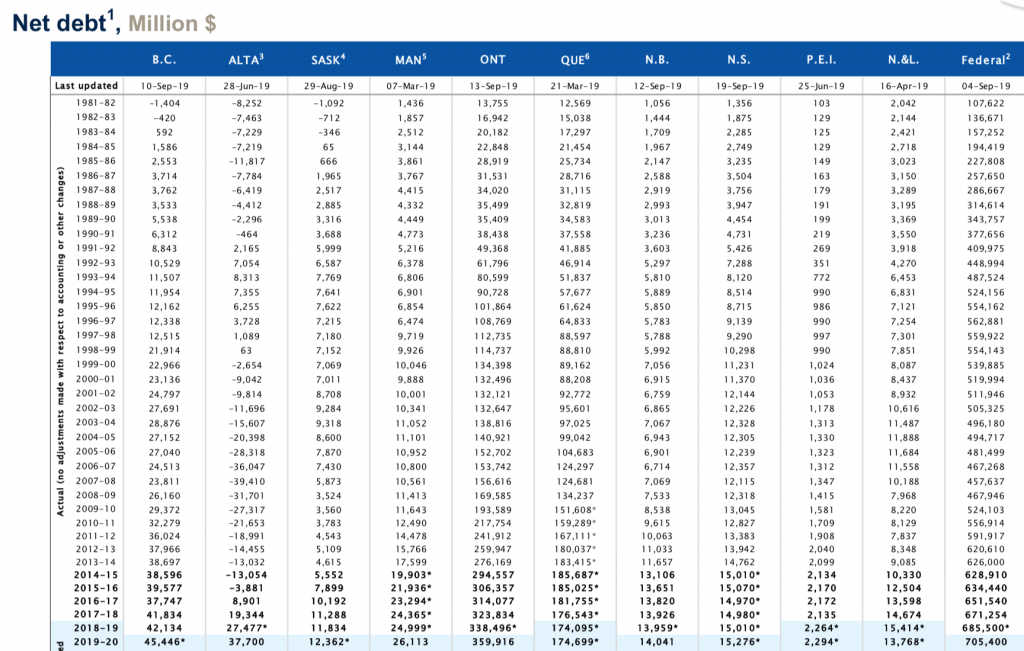

(3) An RBC Debt Chart.

Scan the following chart from 2000-2015, a time of rapidly increasing oil prices to see the Alberta government’s net debt over that period.

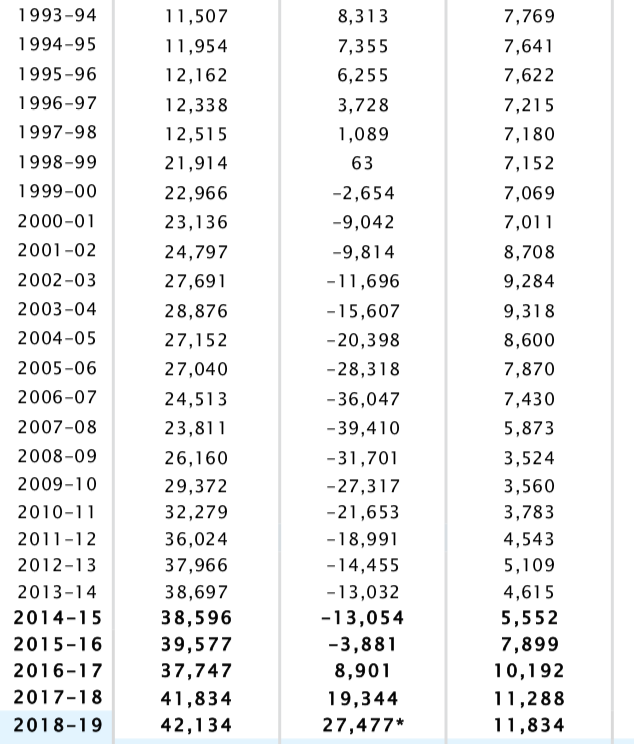

a) From 1999 – 2007, a time when average oil prices rose from $17.00 to $94.00, the Net Debt rose to nearly $-40B. (this means Alberta was setting aside money – it appears as negative debt on the chart)

b) From 2008 – 2015, during a time of record-high oil prices, Alberta dropped to $-3.8B. When the NDP took over the Province was nearly broke. Where did that $80B go? Where did all that money go? Footnote (2) above, provides a partial explanation.

(4) The Rise in Canada’s Debt (above, far right)

If you track the history of the Harper years, the federal debt in February 2006 was $481B. In November 2014 it had risen $626B, about $150B was added to the national debt. And, this was during a time of record-high oil prices. By comparison, over the past four years, the Liberals have added $70B, during a time of record low oil prices. Both governments have overspent, but the Conservatives outpaced the Liberals at a rate to two to one.

(5) Saskatchewan: A Side discussion on the state of their finances (Debt list in column #3)

A cousin in Saskatchewan correctly points out that “from 2001-2007 your comment on Saskatchewan and being governed by fiscal conservatives, is not correct, our Premier was NDPer Lorne Calvert, Brad Wall came after and was a Sask Party leader, as is now Scott Moe. Sask Party members are a party made up of people who were members of all the other parties, Conservative and NDP…not sure of any Liberals though.”

I checked the RBC Debt Chart (a portion above), and, indeed from 2001 – 2007, the NDP era, the debt remained stable at around $7.5B. This was a period of rapidly increasing oil prices, so the extra money must have been pumped into something Saskatchewan needed.

During the Brad Wall era, 2008 – 2o15, a period of exceptionally high oil prices, the debt dropped marginally to $5.8B, then $4B for a couple of years, then by 2015 was back up to $5.5B.

By 2019 the debt had rocketed to just shy of $12B, about the same at Newfoundland. It appears that Brad Wall chose the Danny Williams method, “get out while the gettings good”.

Of course, Scott Moe, who was appointed to replace Brad Wall when Wall bailed in 2018 as the deficit approached $12B, is now left holding the bag. While Saskatchewan is clearly more diversified than Alberta and Newfoundland, they will continue to suffer as they try to adjust to oil prices that are not likely to recover to a level anywhere near the halcyon years when Brad Wall was in power. Perhaps Postash will help, but if the US continues to apply pressure, it does not appear that will happen anytime soon.

Related Posts

Left or Right: Is there a difference?

How to Game and Election

The SNC Lavalin Affair

The Kings of Conservative Media

The Changing Landscape of Politics in Canada

(478)

Tags: Danny Williams, NFLD Bankrupt, fiscal prudence, social conservatives

Trackback from your site.