Are insurance rates soaring across BC?

Scenes like this are all too common in BC and take a tragic toll in lives lost and families destroyed. The cost is high and we all pay but are Insurance Rates out of control in B.C.? Check out this article, as you may be surprised to see where British Columbia sits in relation to other Provinces.

This article is brought forward following an article in the Saanich News stating ICBC rates for some classes of vehicles are grossly inflated as compared to Alberta. Also included are recent updates.

Updated: February 10, 2020

Further to the update below (February 1, 2020), I note that since the government announced a “No-Fault” insurance plan for BC, Robert Mulligan is taking a slightly different tack, suggesting that no-fault will only increase the problems by taking away the right of an injured party to sue.

I’ve copied just one sentence from Mulligan’s longer discussion, “And I think people don’t like the idea that somebody who’s, for example, was drunk and ran into you and you become a quadriplegic is going to be treated exactly the same way you would in terms of getting benefits (go to minute 00:15:26 to see his full comment)

Statements like this appear to be simple fear-mongering. As was the case in the past, people who commit criminal offences, as well as other forms of negligence while driving, may well lose their insurance coverage and in all likelihood would be sued by ICBC to recover costs of the claim. (Link here to Mulligan’s full conversation on CFAX radio)

Updated: February 7, 2020

It is reported ICBC is heading for a 20% rate reduction and largely cutting out lawyers in a change to No-Fault insurance. This will be the largest change to ICBC in several years and will hopefully place the Crown Corporation back on an even keel.

It will be interesting to see how trial-lawyers who earn a large part of their income from ICBC, and the Conservative (aka Liberals) opposition in the Legislature, respond to these changes.

That being said, a February 1, 2020 article by Robert Mulligan, an experienced trial-lawyer, suggested implementing several of the changes currently being proposed by the government.

This will be explored more fully over the next few days.

Read more at CBC Major Overhall of ICBC

Also, a Times Colonist report: Major overhaul at ICBC would limit the ability to sue, cut rates by 20%

Update: February 1, 2020

For an interesting update of the challenges facing ICBC, read a CFAX interview with Robert A. Mulligan titled, “Extinguishing the ICBC Dumpster Fire“. You should disregard the title of the article as it was prepared by a media outlet and does not reflect the considered opinion of a respected, practicing lawyer here in Victoria.

Update: August 20, 2019.

A further article debunks the statement that ICBC rates are soaring and that they are among the highest in Canada: BC News Outlets Exaggerated the Costs of ICBC Insurance

Update: August 13, 2019.

A Global News broadcast this afternoon quoted heavily from an article prepared by the Insurance Bureau of Canada, an Ontario based private enterprise organization that promotes private insurance, which states BC has the highest auto insurance rates in Canada and that rates could be lowered through ‘competition’. There was also an article in the Saanich News which similarily quoted the IBC information and also indicated ICBC is facing a huge deficit. The article made no mention of the considerable sums of money the government has removed from Crown Corporations such as ICBC and BC Hydro.

I have reached out to friends in the Auto Insurance industry to have them fact check the calculations I quote in order to ensure they have legitimacy. (Updated August 14, 2019 – hit the continue reading below for the original article and other updates)

Original Article: (January 29, 2018)

The Apocalypse Now Narrative

While I do not subscribe to a “fake news” narrative, it seems newspaper reporters often pick the worse possible narrative and treat that as if it was the only fact. That is what is now happening with respect to insurance rates in BC where private providers have been fighting the public system, ICBC, for years.

One headline reads, “Drivers facing rate hike as ICBC deficit is expected to hit $1.3 billion” (Vancouver Sun headline, January 29). Other BC News outlets carry a similar doom and gloom narrative about looming debt and rate increases. (note this link became broken for some reason).

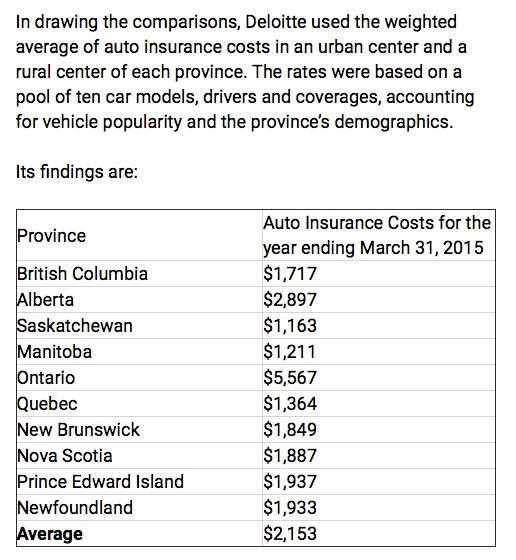

I do not argue ICBC faces a deficit, for reasons noted below, but would it surprise you British Columbia, Saskatchewan, and Manitoba (the three provinces with public auto insurance) are among those with the lowest rates in Canada? Who has the highest? Alberta and Ontario. Alberta is about $1100 per year higher than BC and Ontario, at $5,500 per year, about three times higher. Now to the ICBC debt.

Over the last several years, the provincial government (under the Liberals aka Conservatives) transferred millions from the Corporation into general revenue. It was one means of making the corporation look bad while helping the Liberals to try and balance the books. The following are just two news reports which soundly criticize the practice. In effect, the Conservatives have constantly placed the Corporation in lose-lose position vis a vis their customers. Now the rate comparisons among the Provinces.

Times Colonist (August 2016)

Global National (August 2016)

Some years back the BC government attempted to raid the BC Pension Corporation of a multibillion-dollar fund in the same manner, but an uprising among pensioners and other interested parties help to thwart that attack. By having all that money transferred to an ‘unfunded liability’ of the government you can only imagine the disaster that would have become. Today, those reserve pension funds are among the largest in Canada and growing hourly.

Now to the ICBC situation.

The Data

It is easy to find data on auto insurance rates, but you need to be careful as many reports have a keen interest in promoting private insurance as being the most cost-effective model.

British Columbia, of course, has a public-private system in which basic coverage must be purchased through ICBC with purchasers given the option of adding additional coverage through private insurers. Our family follows the dual coverage option. We have always had competitive rates and our claims experience was excellent although we know other family members who have faced some challenges with ICBC claims.

Over the years the public systems in BC, Saskatchewan, and Manitoba have worked well, with premiums in all three being held at or below the Canadian average. The following chart was prepared by Deloitte LLP, a source considered reliable:

Link to the Deloitte LLP Auto Insurance Report

As Ontario (private) is far above all other regions, one is given to wonder what has gone wrong with its private system. Either the insurance companies are raking off record profits or the drivers in that Province are out of control. Perhaps it’s a combination of both.

Now, reference an article presented by the Insurance Broker’s of Canada who also has a vested interest in private insurance. Their statistics are completely different. BC, Saskatchewan, and Manitoba sit at the top along with Ontario. For each Province, the broker’s report provides a narrative that promotes private insurance. Take a few minutes to read their report.

When it comes to Ontario, however, it’s hard to use the ‘private carrier is better’ message as the cost difference is so massive. What the brokers do to avoid this conflict is to state the high rates in Ontario are a combination of “high-frequency of claims, lawsuits and injuries” along with “high levels of crime and fraudulent claims.” They don’t even mention “private insurance” as being part of the problem. Imagine if Ontario was using a system similar to British Columbia, Saskatchewan or Manitoba, all hell would break loose as the private sector attacked the public system.

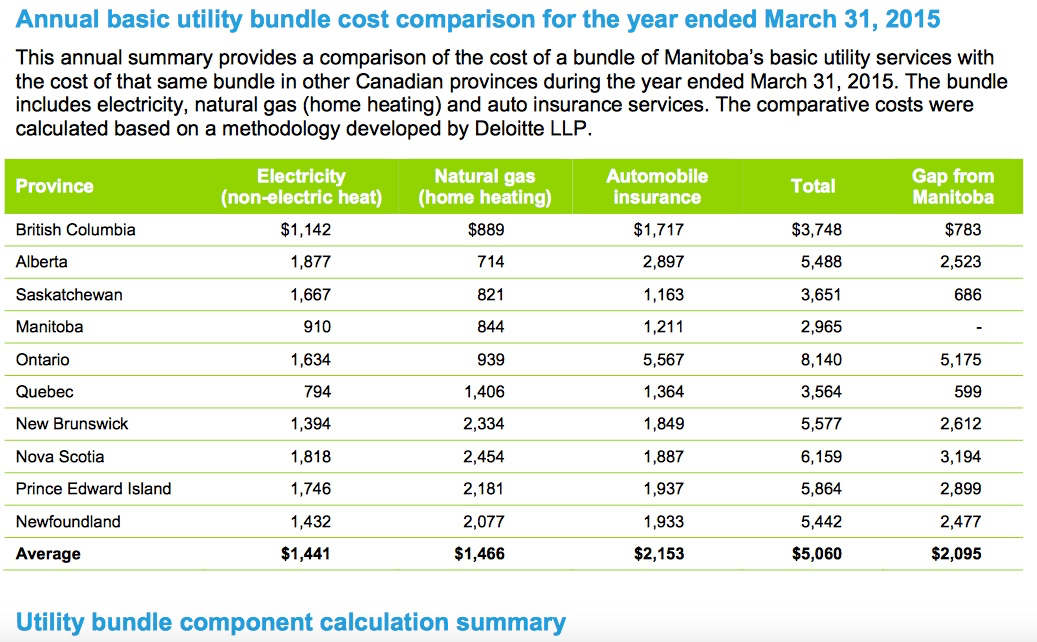

Now take a couple of minutes to read the Deloitte LLP summaries in which comparisons of electric, gas and car insurance costs across Canada is provided (Chart below or Link here to the full Report).

Click to Enlarge and Back Arrow to Return

With the three items included, British Columbia, Saskatchewan, Manitoba, and Quebec, are the lowest with Alberta, Nova Scotia, New Brunswick, and PEI, in the middle of the pack and Ontario, again, is in a class all it’s own at the top.

Assuming ICBC is facing a billion-dollar deficit, it seems an additional average increase of $130 per each policyholder (the suggested amount listed in news reports) will help propel the agency towards balancing the books. Even with that increase, British Columbians will still be among those with the lowest auto insurance rates in Canada.

I hope people will take the time to consider these comparisons before passing a negative judgment on the BC system.

Cheers,

Harold

NOTE: If you have an interest in finding out how British Columbia might find the ways and means to begin reducing the high costs of death and injury on our highways, join Part III of the police series “Changing the way police do business”. Join at Part 5: Traditional Traffic Law Enforcement: the relic of a bygone era.

(1098)

Tags: Insurance Rates, ICBC, Auto Insurance Comparisons

Trackback from your site.

Comments (5)

August 13, 2019. The Insurance Bureau of Canada (IBC), a private enterprise group not unlike the Fraser Institute, is again on the campaign trail. They state ICBC rates are the highest in Canada, but, thankfully, Global BC inserted a section indicating the Insurance Bureau cherry-picked the highest number in BC and the lowest numbers in AB, ON and other Eastern Provinces. If you take a few minutes to check reliable sources you will find BC rates, are the lowest in Canada.

It’s a breath of fresh air to see a resident of British Columbia look to review all the facts over believing what is reported in the news or just following along with the negative stigma of the masses. Your article truly showcases that with a little reform to ICBC’s provincial system – British Columbia could be a true leader for other provinces in Canada. Very well written article!

Many thanks for reviewing the article Elizabeth. There are so many areas of our society in which populism carries the day, although I think what is happening with the ICBC is that groups having a vested interest in private insurance would dearly love to dislodge ICBC from their preferred position. That being said, I think was a good move to have only portions of the insurance coverage in BC being held by ICBC and other portions being made available through private enterprise.

For those who followed the earlier post about the cost of ICBC Auto insurance coverage in British Columbia, Saskatchewan and Manitoba (linked in comments) here is another follow-up article.

This article again confirms earlier assertions that public-private insurers such as that which ICBC provides, is among the best in Canada in terms of rates and coverage. A link is provided in the original story.

Testing the comments section after changes made. Updated: February 10, 2020

Further to the update below (February 1, 2020), I note that since the government announced a “No-Fault” insurance plan for BC, Robert Mulligan is taking a slightly different tack, suggesting that no-fault will only increase the problems by taking away the right of an injured party to sue.

I’ve copied just one sentence from Mulligan’s longer discussion, “And I think people don’t like the idea that somebody who’s, for example, was drunk and ran into you and you become a quadriplegic is going to be treated exactly the same way you would in terms of getting benefits (go to minute 00:15:26 to see his full comment)

Statements like this appear to be simple fear-mongering. As was the case in the past, people who commit criminal offences, as well as other forms of negligence while driving, may well lose their insurance coverage and in all likelihood would be sued by ICBC to recover costs of the claim. (Link here to Mulligan’s full conversation on CFAX radio)